Comparing coverage: What's the difference between an HMO, PPO, and EPO?

There are many acronyms used in health insurance that define different plan selections. For example, you’ve probably heard of an HMO or PPO — and maybe even an EPO. So, how do you know which plan to choose? Continue reading to learn about the differences between these plans and which option may work best for you and your health needs.

When choosing health insurance coverage, you may have the option to enroll in one of the following types of plans:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Exclusive Provider Organization (EPO)

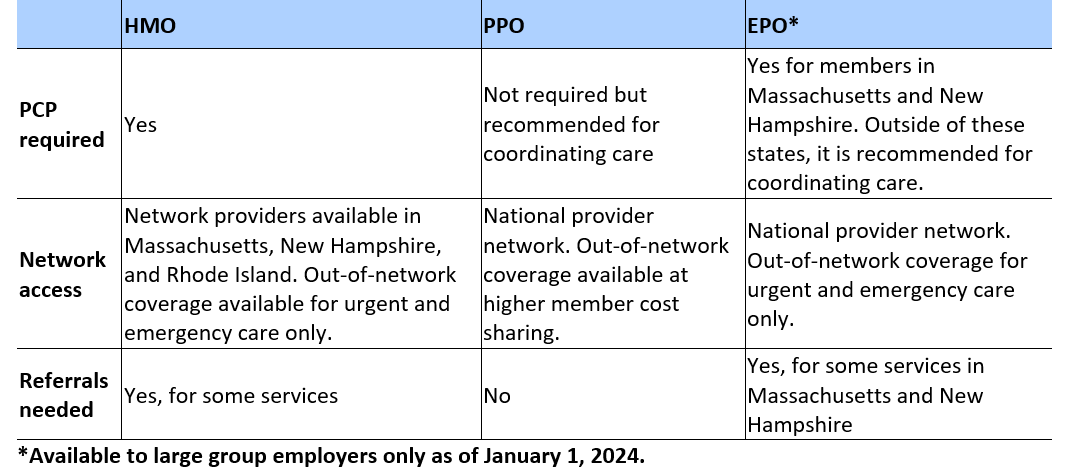

Each plan differs in its primary care provider (PCP) requirements, network access, and referral requirements. Below is a quick breakdown of the three types of plans:

What is a Health Maintenance Organization (HMO)?

An HMO provides a local network of doctors and hospitals, giving you the convenience of a wide range of options. An HMO is a fantastic choice if your provider is in the local network and you prefer having a PCP coordinate your healthcare. Explore HMO plans with Mass General Brigham Health Plan.

What is a Preferred Provider Organization (PPO)?

A PPO offers a national network, providing you with the freedom to choose from a larger pool of doctors and hospitals and allowing access to out-of-network providers. The added flexibility and choice in selecting your provider and healthcare options make a PPO plan well worth considering. Explore PPO plans with Mass General Brigham Health Plan.

What is an Exclusive Provider Organization (EPO)?

With a national network of doctors and hospitals, an EPO plan is not only affordable but also a flexible option for accessing care. It’s important to note that out-of-network coverage is only available for urgent and emergency care.

Which health plan is right for me?

Deciding which health plan works for you depends on factors such as cost and if you prefer a national network, an option for out-of-network coverage, and a PCP that coordinates care.

You can explore plan options with Mass General Brigham Health Plan.

What’s the difference between in-network and out-of-network coverage?

When it comes to seeking medical care, PPO members have the freedom to choose their providers. By visiting an in-network provider, your care will be covered by your plan, and your out-of-pocket costs will be lower. However, if you decide to see a provider outside of the plan’s network, your out-of-pocket costs will likely be higher, except for emergency care.

What’s a referral?

If you require specialized care or specific medical services, your PCP can provide a written referral for you to receive those services. For HMO and some EPO plan members, a referral may be necessary before receiving medical care from anyone other than your PCP. Failure to obtain a referral in advance could result in the plan not covering the services.

To learn more about choosing the right plan for you, read our recent blog post: Common health insurance terms and what they mean.